Introduction: The Road to $200K Bitcoin

Bitcoin’s price movements have always followed cyclical patterns, but this time, the convergence of institutional adoption, ETF inflows, and sovereign nation accumulation could propel BTC to unprecedented heights—potentially $200,000 or beyond.

In this analysis, I’ll break down Claude AI’s four-phase Bitcoin supercycle, revealing how each stage builds toward a historic bull run. You’ll learn:

- The four critical phases of Bitcoin’s growth cycle

- How Bitcoin ETFs are creating a supply shock

- Institutional and sovereign adoption triggers

- Key predictive metrics to track for maximum alpha

- The sovereign cascade effect that could accelerate Bitcoin’s rise

By the end, you’ll have a data-driven framework to anticipate Bitcoin’s next parabolic move.

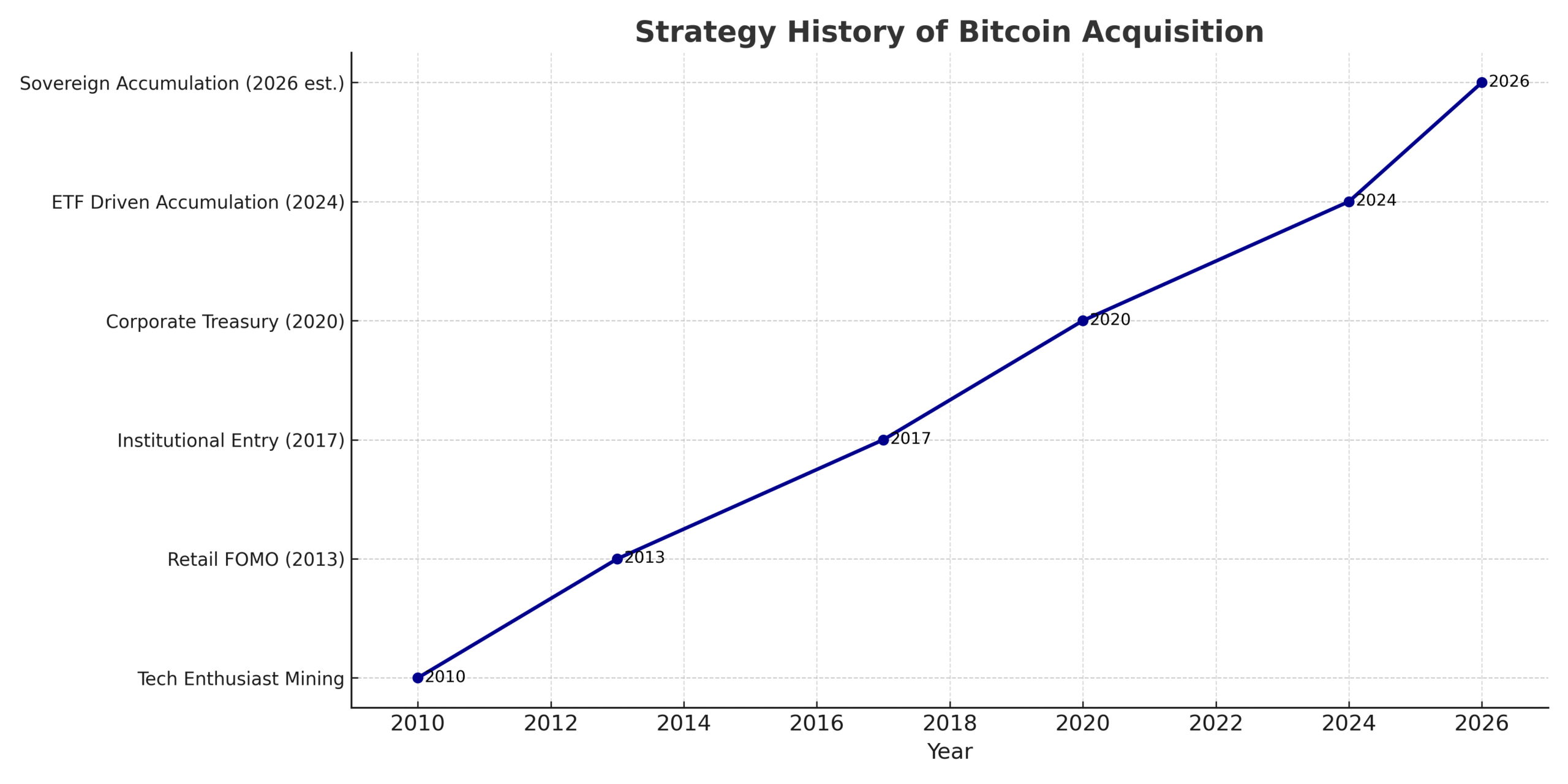

1.Four-Phase Bitcoin Supercycle

Bitcoin’s price doesn’t move randomly—it follows predictable cycles driven by adoption, liquidity, and macroeconomic factors. Claude AI’s framework identifies four key phases:

Phase 1: Accumulation (Post-Halving Quiet Period)

- After each Bitcoin halving, miners’ rewards are cut in half, reducing new supply.

- Historically, this leads to a 12–18-month accumulation phase where smart money (whales, institutions) buys at lower prices.

- Current stage: We’re in this phase now (post-2024 halving).

Phase 2: Institutional Adoption & ETF Inflows

- Spot Bitcoin ETFs (like BlackRock’s IBIT) are buying 10x more BTC than daily production.

- Supply shock incoming: If demand stays high, available BTC on exchanges will dwindle, forcing prices up.

Phase 3: Sovereign Nation Accumulation

- Countries like El Salvador and Bhutan already hold Bitcoin.

- More nations will follow, creating a domino effect (the “sovereign cascade”).

Phase 4: Parabolic Rally & Retail FOMO

- Once institutions and nations hold BTC, retail investors pile in, driving a final speculative surge.

- $200K target aligns with past cycle multiples.

2. Bitcoin ETFs Are Fueling a Supply Shock

The introduction of spot Bitcoin ETFs has changed the game. Here’s why:

- BlackRock, Fidelity, and Ark Invest are buying ~10,000 BTC daily.

- Bitcoin’s daily production? Only 900 BTC post-halving.

- Net deficit: Demand is outpacing supply by 10:1.

Key Takeaway: If ETF inflows continue, available Bitcoin liquidity will dry up, leading to explosive price

moves.

3. Institutional Adoption Is Accelerating

Beyond ETFs, institutions are entering Bitcoin in three major ways:

- Corporate Treasuries (MicroStrategy now holds over 214,000 BTC).

- Hedge Funds & Family Offices (Paul Tudor Jones, Stanley Druckenmiller).

- Pension Funds & Endowments (University of Wyoming’s BTC endowment).

Why It Matters: When institutions buy, they hold long-term, reducing circulating supply.

4. Sovereign Adoption & The Domino Effect

Nations are starting to hoard Bitcoin, creating a sovereign cascade:

- El Salvador (first country to make BTC legal tender).

- Bhutan (secretly mining and accumulating BTC).

- Next in line? Argentina, UAE, and others exploring Bitcoin reserves.

Trigger Point: If one major economy (like China or Saudi Arabia) allocates 1% of reserves to Bitcoin, others will follow.

5. Key Predictive Metrics for $200K BTC

To forecast Bitcoin’s rise, track these five critical indicators:

- ETF Net Inflows (sustained buying = higher prices).

- Exchange Reserves (declining supply = bullish).

- Miner Selling Pressure (if miners hold, supply tightens).

- Institutional Holdings (MicroStrategy, Tesla, ETFs).

- Macroeconomic Trends (dollar weakness, inflation).

6. The Sovereign Cascade Trigger

The tipping point for Bitcoin’s next leg up will be sovereign adoption:

- Stage 1: Small nations (El Salvador, Bhutan) adopt.

- Stage 2: Mid-sized economies (Argentina, UAE) follow.

- Stage 3: A major economy (China, Saudi Arabia) allocates reserves.

Result: A global rush into Bitcoin as a reserve asset.

7. The Window of Convergence

We’re now in a rare alignment of bullish factors:

✅ Post-halving supply crunch

✅ ETF-driven demand surge

✅ Institutional accumulation

✅ Macroeconomic instability

Timeline: The next 12–18 months could see Bitcoin’s biggest rally yet.

8. Macro Outlook: Why $200K Is Realistic

Comparing past cycles:

- 2017 Bull Run: ~20x from bottom to peak.

- 2021 Bull Run: ~18x from bottom to peak.

- 2024–2025? If Bitcoin follows a similar pattern, $200K is achievable.

9. How to Front-Run the Next Bitcoin Surge

Actionable Steps:

- Track ETF flows (BlackRock, Fidelity).

- Monitor exchange reserves (declining = bullish).

- Watch miner behavior (are they holding or selling?).

- Follow sovereign adoption news (next country to buy?).

10. Conclusion: Prepare for the Bitcoin Supercycle

Bitcoin’s path to $200K is forming, driven by ETFs, institutions, and sovereign nations. The four-phase supercycle suggests we’re still early in the accumulation stage.

Now is the time to:

- Stack Bitcoin before the supply shock worsens.

- Monitor key metrics to spot trend reversals.

- Prepare for the sovereign cascade that could send BTC parabolic.

Are you ready for the ride?

FAQ Section

1. When will Bitcoin hit $200K?

Based on past cycles, late 2025 is a realistic target if ETF inflows and institutional demand persist.

2. What’s the biggest risk to this prediction?

A prolonged bear market or regulatory crackdown could delay the rally, but the long-term trend remains bullish.

3. How do Bitcoin ETFs affect price?

ETFs buy real Bitcoin, reducing available supply. If demand stays high, prices must rise.

4. Which countries are next to adopt Bitcoin?

Watch Argentina, UAE, and Singapore—they’ve shown the most interest.

5. Should I sell at $200K?

Consider taking profits incrementally, but holding a long-term stash is wise for the next supercycle.

6. What’s the best indicator for Bitcoin’s price?

ETF inflows + exchange reserves are the most reliable short-term signals.

Leave A Comment