Introduction:

Ethereum (ETH) has recently encountered a critical juncture, touching a vital support level at $1450. Historical data reveals that this level has consistently prompted significant price rebounds, signaling robust market sentiment. Furthermore, the emergence of a double-bottom pattern adds a layer of optimism, suggesting a potential bullish reversal. Traders and investors closely monitor these indicators, anticipating a favorable upswing toward the $1690 resistance level.

ETH has reached its major support.

ETH has reached its major support level at $1450, where it has shown frequent bounces in the past.

ETH is also forming a double-bottom pattern, which is a bullish reversal pattern.

If ETH follows this pattern, we can expect a bullish move in its price, potentially testing the $1690 level.

Technical Analysis:

ETH’s resilience at the $1450 support level underscores the strength of buyer interest. Traders are keenly observing the developing double-bottom pattern, a reliable bullish reversal formation. Confirmation of this pattern could pave the way for a noteworthy price surge, potentially challenging the $1690 resistance. As always, market participants need to remain vigilant and respond to confirmatory signals to capitalize on potential market movements.

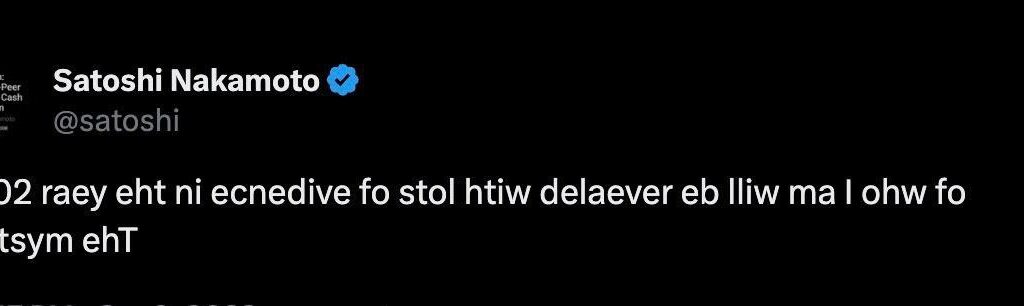

Satoshi’s account on X just dropped a tweet in reverse.

The mystery of who I am will be revealed with lots of evidence in 2024.

This account is associated with self-proclaimed Bitcoin inventor Craig Wright.

Crypto News Roundup:

Satoshi’s Account Revelation:

- The crypto community is abuzz with speculation following a cryptic reverse tweet from Satoshi’s account.

- Linked to Craig Wright, the self-proclaimed Bitcoin inventor, this revelation, promised in 2024, introduces an air of anticipation to the crypto landscape.

- Crypto Venture Funding Decline:

- Venture funding in the crypto sector experiences a significant contraction, reminiscent of levels observed in 2020.

- The fallout from the SBF trial is identified as a primary contributor to this decline, reflecting the impact of regulatory uncertainties on investor confidence.

- UPbit’s AI-Driven Security Measures:

- Amid a surge of hacking attempts, South Korean exchange UPbit deploys advanced AI-driven security measures.

- This successful defense against a 1,800% increase in hacking attempts underscores the importance of evolving cybersecurity measures in the crypto industry.

- Unauthorized Operators in the UK:

- The UK’s FCA raises alarms by listing HTX and KuCoin among unauthorized crypto exchanges.

- Traders are reminded of the necessity for due diligence and regulatory compliance, emphasizing the volatile and evolving nature of the crypto market.

- SBF Trial Restriction:

- In the ongoing trial of Sam Bankman-Fried (SBF), the DOJ imposes restrictions on highlighting Anthropic investment.

- This legal development adds complexity to the regulatory landscape surrounding crypto entrepreneurs, emphasizing the need for clarity in legal proceedings.

Venture funding for crypto hits lows last seen in 2020 due to SBF trial fallout.

South Korean UPbit counters a 1,800% surge in hacking attempts with AI-driven security measures.

HTX and KuCoin are among exchanges on the UK’s FCA unauthorized operators (https://cryptoslate.com/huobi-

Sam Bankman-Fried Trial: DOJ forbids SBF from highlighting Anthropic investment.

Conclusion:

In summary, Ethereum’s recent interaction with the $1450 support, coupled with the promising double-bottom pattern, sets the stage for potential bullish momentum. As the crypto market navigates regulatory challenges and security concerns, staying informed and adaptive is crucial for investors.

FAQs:

Q: Why is the $1450 support level significant for ETH?

- A: Historically, $1450 has acted as a strong support level, prompting substantial price rebounds and reflecting robust market sentiment.

Q: How can traders confirm the double-bottom pattern for potential bullish momentum?

- A: Traders should await confirmatory signals, such as a decisive upward price movement following the pattern’s formation, to validate the bullish reversal.

Q: What impact does the decline in venture funding have on crypto innovation?

- A: The funding decline, linked to the fallout from the SBF trial, may hinder innovation by limiting resources for crypto projects, potentially slowing down industry development.

Q: Why is UPbit’s successful defense against hacking attempts significant?

- A: UPbit’s use of AI-driven security measures showcases the industry’s commitment to enhancing cybersecurity, providing a blueprint for other exchanges to follow suit.

Q: How does the listing of exchanges as unauthorized operators by the FCA affect traders?

- A: Traders are urged to exercise caution, emphasizing the importance of regulatory compliance to mitigate risks associated with trading on unauthorized platforms.