Introduction:

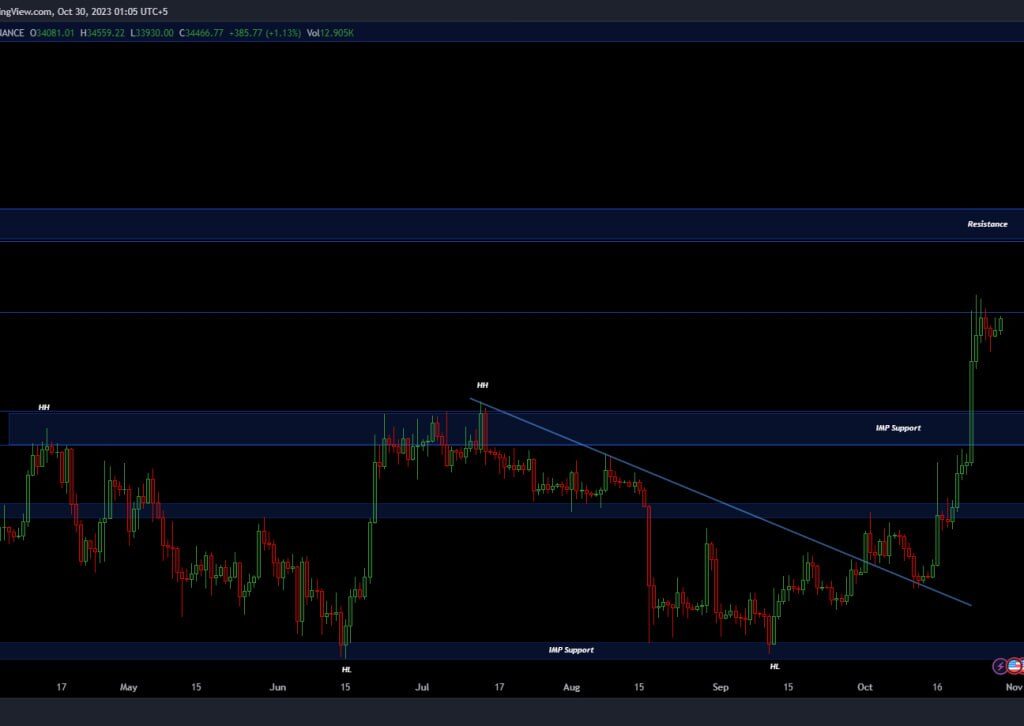

Cryptocurrency trading presents opportunities, and being well-informed is essential for success. In this comprehensive article, we will delve into two promising assets, GAL and APT, and discuss a fascinating opportunity within the Binance platform – the Grid BOT Trades. Let’s explore how recent developments impact these assets and how you can benefit from them.

Understanding GAL and Its Recent Developments.

GAL, also known as Galxe, has been making waves in the crypto world. To begin, let’s understand the recent developments surrounding this asset. On November 5th, a 13% supply unlock was anticipated, but it turned out to be around 5%. Surprisingly, GAL’s price soared from $1.35109 to the current $1.41, indicating a strong resistance breakout.

GAL’s Supply Unlock and Price Movement.

The recent supply unlock was a significant event, with the market expecting 13%, but it was much less. This unexpected twist might contribute to the price surge. While the breakout is a positive sign, it’s crucial to exercise caution as rapid price movements can be unpredictable. Traders are closely monitoring GAL for potential profit opportunities.

Analyzing GAL’s Resistance Breakout.

GAL’s resistance breakout is a noteworthy development. It signals the potential for further price increases. However, it’s vital to be cautious, as rapid price movements can quickly turn the tides. Traders are keeping a watchful eye on GAL, ready to seize profitable opportunities.

The uncertainty surrounding GAL.

The cryptocurrency market is notorious for its unpredictability, and GAL is no exception. While recent developments have been encouraging, the market can change rapidly. Staying informed and making well-researched decisions are paramount to success.

Aptos Token Unlock – What to Expect.

Another cryptocurrency that’s garnering attention is APT. On November 12th, there’s an upcoming $168 million token unlock. Currently, the token is near its resistance level, and this unlock event could lead to a breakout or a price reversal. Some experts believe APT might reach $6.18 before November 12th, potentially providing a selling opportunity.

Potential Price Movements of APT.

The potential price movements of APT before the token unlock have piqued interest among traders. Investors are assessing their positions and weighing the associated risks and rewards. Keep a close eye on APT in the coming days for potential trade opportunities.

The Opportunity in Binance’s Grid BOT Trades.

Binance, a leading cryptocurrency exchange, is offering an enticing opportunity through its Grid BOT Trades. This opportunity is particularly appealing in a bullish market mode. To participate, you need capital ranging from $200 to $350 and can set your grid size between $50-100.

Making the Most of Binance’s Grid BOT

If you are new to grid bot trading and haven’t invested in Binance’s native token, BNB, this is an ideal time to start. With a low funding rate of 0.01%, holding a sell position in BNB can be highly advantageous.

Exploring Binance’s Grid BOT Features

Binance’s Grid BOT Trades offer a range of features to optimize your trading experience. It’s essential to understand these features, including grid size, market modes, and funding rates, to make the most of this trading opportunity.

Grid trading bots, in general, operate based on a strategy known as grid trading. Here are some common features associated with grid trading bots:

- Grid Configuration: Users can set up a grid of buy and sell orders at predefined intervals. The grid consists of both buy and sell orders, creating a trading range.

- Range Definition: Traders can specify the upper and lower bounds of the trading range. The bot automatically places buy orders as the price drops and sell orders as the price rises within the defined range.

- Profit Accumulation: By capturing price movements within the specified range, the grid trading bot aims to accumulate profits over time.

- Grid Spacing: Traders can set the distance between each buy/sell order, determining the granularity of the grid.

- Safety Measures: Some bots incorporate safety features, such as stop-loss orders or other risk management tools, to mitigate potential losses.

- Market Analysis: Advanced grid bots may use technical indicators or machine learning algorithms for market analysis, helping to adapt to changing market conditions.

Conclusion.

The cryptocurrency market is brimming with opportunities, and staying informed about recent developments is critical to success. GAL’s resistance breakout and APT’s upcoming token unlock present exciting prospects for traders. Moreover, Binance’s Grid BOT Trades offer a brilliant way to capitalize on market volatility. Exercise caution, stay informed, and make your moves wisely to navigate this ever-evolving landscape.

FAQs

- Is investing in GAL a good idea after the recent price increase?

While GAL has shown a resistance breakout, it’s essential to exercise caution and assess the market’s current conditions before making an investment decision.

- What should I expect from APT’s price movement before the token unlocks on November 12th?

There is a possibility that APT might reach $6.18 before the token unlocks, but the crypto market is unpredictable, so it’s essential to stay updated.

- How can I get started with Binance’s Grid BOT Trades?

To get started with Binance’s Grid BOT Trades, you need to have a Binance account, capital of $200 to $350, and set your grid size between 50-100.

- Are great bot trades suitable for beginners?

Network bot exchanging can be appropriate for tenderfoots, but it’s significant to get it the nuts and bolts of cryptocurrency exchanging and be mindful of the dangers included.

- What components ought I consider when making venture choices within the cryptocurrency showcase?

When making speculation choices within the cryptocurrency showcase, consider components like later advancements, advertise estimation, and hazard resistance. Always conduct thorough research before investing.