Introduction:

Within the ever-volatile world of cryptocurrencies, Bitcoin proceeds to be a captivating subject. Let’s dig into the later improvements to get the current state of the crypto lord.

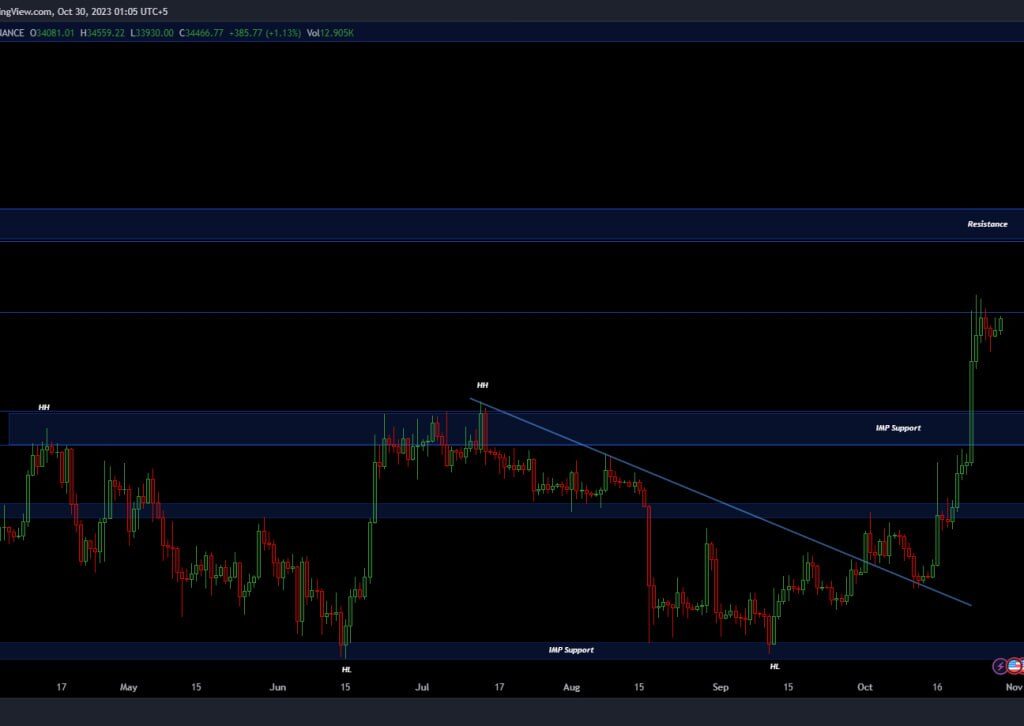

Bitcoin’s Weekly Candle: A Glimpse into the Battle

The recent Bitcoin weekly candle closed in the green, aligning with our expectations. This green candle is more than just a color change; it’s a pivotal indicator of the ongoing battle between bulls and bears. As we dive into the points of interest, it becomes apparent that the bulls are making a confident move, pointing to thrust the cost upward. In the meantime, the bears show up to be losing their grasp on the showcase, making this an energizing time for crypto devotees.

$37,500: The Critical Resistance Level.

As Bitcoin’s price surges, it faces a substantial hurdle in the form of the $37,500 resistance level. This level is significant because it has acted as a formidable barrier in the past, a point at which bullish momentum often comes to a halt. A breakthrough here could be the catalyst that propels Bitcoin’s price toward the coveted $40,000 mark. Traders and investors worldwide are keenly watching this level, knowing that it could be a game-changer for the cryptocurrency.

$32,600: A Sturdy Support Level.

Conversely, the crypto market also has its eyes on the $32,600 mark. This level is currently serving as a reliable support zone for Bitcoin. If the price experiences a downward pull, many in the community expect it will find support at this level. It acts as a safety net, preventing the price from slipping too dramatically. In times of uncertainty, support levels like these offer a sense of reassurance to investors and traders alike.

Bitcoin’s Current Range: Balancing Act.

Presently, Bitcoin is maintaining a price range between $34,000 and $35,000. This range demonstrates a period of consolidation, which often occurs before significant market movements. It’s a stage where the cryptocurrency is gathering its quality, and planning for another huge move. Such minutes are basic for both short-term dealers and long-term speculators to create educated choices.

Future Resistance and Support Zones

Beyond the current price levels, the crypto community is closely monitoring the $37,000 to $38,000 range. These are anticipated to be the next critical resistance levels that Bitcoin will need to tackle. Success here could set the stage for an exciting surge in price. Conversely, should Bitcoin face a temporary setback, two important support zones lie at $31,500 and $30,500. These act as safety barriers and serve as fallbacks to stabilize the market.

The Anticipated Move: What Lies Ahead?

With Bitcoin’s price dynamics playing out in real-time, the crypto world is rife with speculation. Many foresee Bitcoin pushing toward the $37,000 mark, anticipating bullish momentum to carry it further. However, others exercise caution, expecting a price correction to follow this surge. In the world of cryptocurrencies, such variations in expectations are par for the course, making it an exciting and unpredictable environment.

Conclusion:

In conclusion, Bitcoin’s recent performance indicates that the bulls are regaining control, supported by the positive green candle. However, the road ahead is fraught with challenges, particularly the $37,500 resistance level. On the flip side, $32,600 stands as a robust support level, providing a cushion in case of a downturn. The $37,000 to $38,000 range represents the next battlefield for Bitcoin, with $31,500 and $30,500 as reliable safety nets below. As the crypto world watches with bated breath, the outcome remains uncertain, leaving room for diverse market expectations to flourish.

FAQs: Bulls Gain Control as Price Nears Critical Levels.

1. What does the recent green weekly candle in Bitcoin signify?

- The recent green weekly candle in Bitcoin signifies a pivotal indicator of the ongoing battle between bulls and bears. It suggests that bulls are making a confident move, aiming to push the price upward, while bears appear to be losing their grip on the market.

2. Why is the $37,500 resistance level crucial for Bitcoin?

- The $37,500 resistance level is significant because it has historically acted as a formidable barrier, often halting bullish momentum. A breakthrough at this level could be a catalyst for Bitcoin’s price to reach the coveted $40,000 mark, making it a crucial point closely monitored by traders and investors worldwide.

3. What is the $32,600 level in Bitcoin’s context?

- The $32,600 level serves as a sturdy support zone for Bitcoin. If the price experiences a downward pull, many in the community expect it to find support at this level. It acts as a safety net, preventing the price from slipping too dramatically and offering reassurance to investors and traders in times of uncertainty.

4. What is the current price range for Bitcoin, and what does it signify?

- Currently, Bitcoin is maintaining a price range between $34,000 and $35,000. This range suggests a period of consolidation, where the cryptocurrency gathers strength and prepares for significant market movements. It is a crucial stage for both short-term traders and long-term investors to make informed decisions.

5. What are the future resistance and support zones for Bitcoin?

- Beyond the current levels, the crypto community is closely monitoring the $37,000 to $38,000 range as Bitcoin’s next critical resistance level. Success here could lead to an exciting surge in price. In case of a setback, important support zones are identified at $31,500 and $30,500, acting as safety barriers to stabilize the market.

6. What are the varied expectations regarding Bitcoin’s future move?

- There are diverse expectations within the crypto community regarding Bitcoin’s future move. Some anticipate a push towards the $37,000 mark with bullish momentum, while others exercise caution, expecting a potential price correction following the surge. The unpredictable nature of the crypto world fosters a variety of market expectations.

7. What is the conclusion drawn from Bitcoin’s recent performance?

- In conclusion, Bitcoin’s recent performance suggests that the bulls are regaining control, supported by the positive green candle. However, challenges lie ahead, particularly at the $37,500 resistance level. The $32,600 support level provides a robust cushion. The $37,000 to $38,000 range represents the next battleground, with $31,500 and $30,500 as reliable safety nets below. The outcome remains uncertain, allowing for diverse market expectations.

Leave A Comment