Introduction:

Within the unstable world of cryptocurrencies, Bitcoin is continuously beneath the highlight. Nowadays, let’s take a closer see at the current circumstance with Bitcoin’s cost and up-and-coming token opens.

Bitcoin’s Recent Pattern:

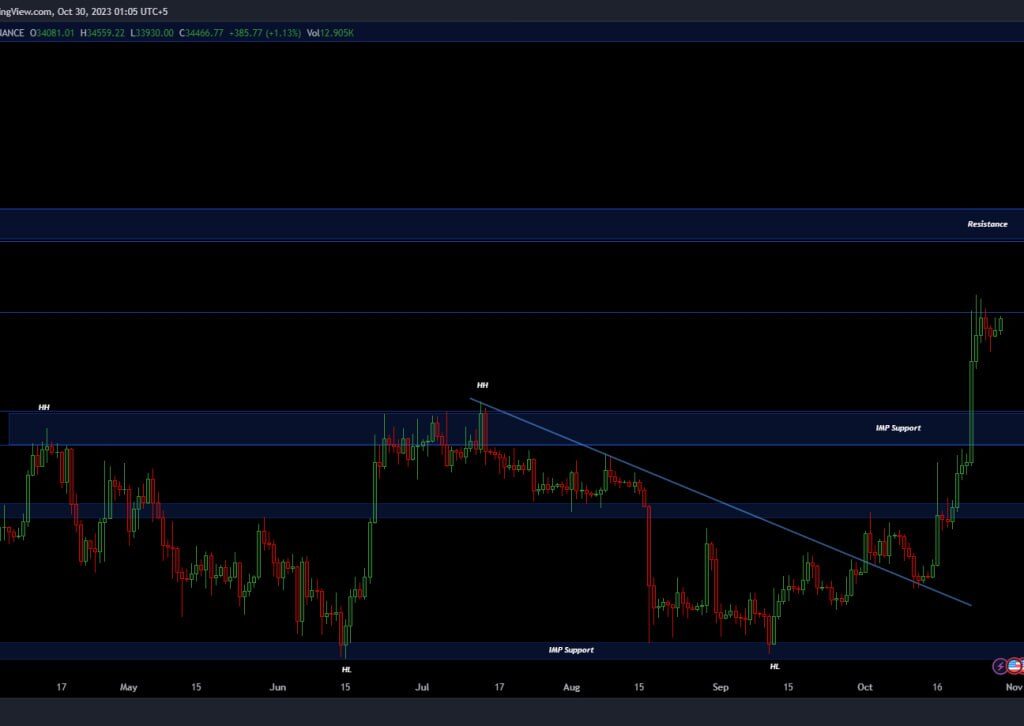

In the 1-hour time frame, Bitcoin is forming an ascending channel. This pattern, though, is bearish, which has caught the attention of traders and investors alike.

If history is any indicator, when Bitcoin follows this pattern, we often see a breakdown. The price tends to head south towards its immediate support level, which, in this case, hovers around $33,200.

| Contents |

|---|

| 1. Introduction |

| – Unstable World of Cryptocurrencies |

| – Focus on Bitcoin’s Price and Upcoming Token Unlocks |

| 2. Bitcoin’s Recent Pattern |

| – Ascending Channel in the 1-hour Time Frame |

| – Bearish Nature and Attention from Traders |

| – Historical Indicators and Potential Breakdown |

| 3. Token Unlocks |

| – Overview of Significant Token Unlocks |

| – SUI ($159.7M) |

| – ImmutableX ($24.1M) |

| – DYDX ($16.9M) |

| – GALXE ($11M) |

| – Nym ($9M) |

| – Orbler ($8.5M) |

| – Biconomy ($6.9M) |

| 4. Analyzing the Situation |

| – Combination of Bitcoin’s Pattern and Token Unlocks |

| – Climate of Uncertainty in the Cryptocurrency Market |

| 5. Risk and Opportunity |

| – Volatility as a Double-Edged Sword |

| – The Role of Risk and Potential Gains |

| – Impact of Token Unlocks on Market Dynamics |

| 6. Importance of Informed Decision-Making |

| – Vigilance and Knowledge as Allies |

| – Planning for the Unforeseen in the Crypto World |

| 7. Conclusion |

| – Challenging yet Potentially Fulfilling Landscape |

| – Navigating Instabilities with Analysis and Planning |

| – Stay Tuned for Updates in the Cryptocurrency World |

Critical Support Level.

For Bitcoin enthusiasts, this is a crucial moment. The cryptocurrency needs to bounce back from this support level. A breakdown of this support could spell trouble, sending the price further down to around $32,500.

Investors are closely watching how Bitcoin behaves in this scenario. The market sentiment can shift rapidly, so it’s a waiting game for many.

Token Unlocks.

Now, let’s shift our focus to some significant token unlocks scheduled for the upcoming week. These events can have a substantial impact on the market.

SUI – $159.7M: The SUI token’s unlock is a major event, with a significant value. Its release could sway the market in different directions.

ImmutableX – $24.1M: ImmutableX, with its $24.1 million token unlock, is another player in the upcoming week’s events. Keep a close eye on how this affects the crypto space.

DYDX – $16.9M: DYDX joins the ranks with its token unlock of $16.9 million. Market dynamics might shift as these tokens become accessible.

GALXE – $11M: GALXE’s token unlock is worth $11 million. The market often responds to such substantial releases.

Nym – $9M: Nym’s $9 million unlock adds to the mix. Cryptocurrency enthusiasts will be monitoring the impact closely.

Orbler – $8.5M: With an $8.5 million unlock, Orbler makes its presence felt. Such events are often opportunities for traders.

Biconomy – $6.9M: Finally, Biconomy steps into the limelight with its $6.9 million token unlock. These releases create ripples in the market.

Analyzing the Situation.

The combination of a potentially bearish pattern in Bitcoin’s price and these substantial token unlocks creates a climate of uncertainty in the cryptocurrency market.

Speculators are hooking with the address of whether Bitcoin will proceed with its descending drift or in case it’ll discover the support it has to bounce back. It’s a situation that grandstands the inborn instability within the crypto space, where costs can swing fiercely inside brief periods.

Risk and Opportunity.

With risk comes opportunity. Within the world of cryptocurrencies, instability may be a double-edged sword. Whereas it can lead to sharp misfortunes, it can also result in critical picks up. Dealers with a tall resistance to chance regularly flourish in this environment, but they confront the plausibility of considerable misfortunes.

The upcoming token unlocks can either add fuel to the fire or provide the stability the market needs. It’s a matter of how these tokens are utilized and the confidence they instill in investors.

The Importance of Informed Decision-Making.

As always, when it comes to cryptocurrencies, vigilance and knowledge are your best allies. Remain educated and arrange for the unforeseen, as the crypto world is known for its shocks. We’ll be keeping a near observation on these improvements and overhaul you as they unfurl.

Whether you are a prepared investor or fair getting begun within the world of cryptocurrencies, keep in mind that advertising elements can alter quickly. It’s fundamental to survey your chance resistance, set clear methodologies, and arrange for an assortment of results.

Conclusion.

In conclusion, Bitcoin’s current design and the up-and-coming token open display a challenging but possibly fulfilling scene. With cautious investigation and strategic planning, speculators can explore these instabilities and make the most of the openings displayed by the crypto market. Remain tuned for advance overhauls as we track the unfurling occasions within the ever-exciting world of cryptocurrency.

FAQs:

- What is the current pattern in Bitcoin’s price?

- In the 1-hour time frame, Bitcoin is forming an ascending channel, which is bearish and has drawn attention from traders and investors.

- What historical indicators suggest about Bitcoin’s current pattern?

- Historical indicators suggest that when Bitcoin follows this ascending channel pattern, there is often a breakdown, leading the price to head south toward its immediate support level, approximately $33,200.

- Why is $33,200 a crucial level for Bitcoin enthusiasts?

- $33,200 is a crucial level because it represents immediate support for Bitcoin. A breakdown below this level could potentially lead to further decline, with $32,500 being the next significant support.

- What are the significant token unlocks scheduled for the upcoming week?

- Significant token unlocks include SUI ($159.7M), ImmutableX ($24.1M), DYDX ($16.9M), GALXE ($11M), Nym ($9M), Orbler ($8.5M), and Biconomy ($6.9M).

- Why are token unlocks important for the market?

- Token unlocks can have a substantial impact on the market, influencing its dynamics and potentially leading to market shifts.

- How does the combination of Bitcoin’s pattern and token unlocks create uncertainty in the market?

- The potentially bearish pattern in Bitcoin’s price combined with substantial token unlocks creates a climate of uncertainty, as speculators are unsure whether Bitcoin will continue its descending trend or find the support needed to bounce back.

- What role does risk play in the cryptocurrency market?

- Risk is inherent in the cryptocurrency market, serving as both a challenge and an opportunity. While it can lead to losses, it can also result in significant gains.

- Why is informed decision-making crucial in the cryptocurrency market?

- Informed decision-making is crucial due to the inherent volatility in the crypto space. Vigilance, knowledge, and strategic planning are essential for navigating the market effectively.